APAC Asset Management's Cost Illusion: Is Your Analytics Platform High-Interest Technical Debt?

- Connie Tong

- Aug 19

- 4 min read

The Hidden Costs in APAC Asset Management: A Strategic Blind Spot

For firms in APAC asset management, the world's most dynamic engine of wealth creation, the price of any strategic misstep is exceptionally high. When your CFO presents that multi-million dollar subscription fee for the "industry-standard" analytics platform, are you seeing the real cost, or a dangerous illusion?

Boston Consulting Group forecasts that by 2029, the Asia-Pacific will lead the globe with a staggering 9% compound annual growth rate in financial wealth (BCG, 2025). In such a land of opportunity, the "cost illusion" is far more damaging. It deceives you into believing a massive expenditure is a "technology asset," when in reality, it may have quietly morphed into "high-interest technical debt" that erodes your firm's future.

This article aims to pierce this illusion with you and confront a long-overlooked strategic problem.

Redefining Platform Cost: Calculating the True Total Cost of Ownership (TCO)

Do you believe your platform's cost is simply the procurement price plus maintenance fees? This traditional calculation may be causing you to overlook up to 90% of hidden costs. The true Total Cost of Ownership (TCO) for your financial software extends far beyond that.

To see the full picture, you must adopt this comprehensive framework:

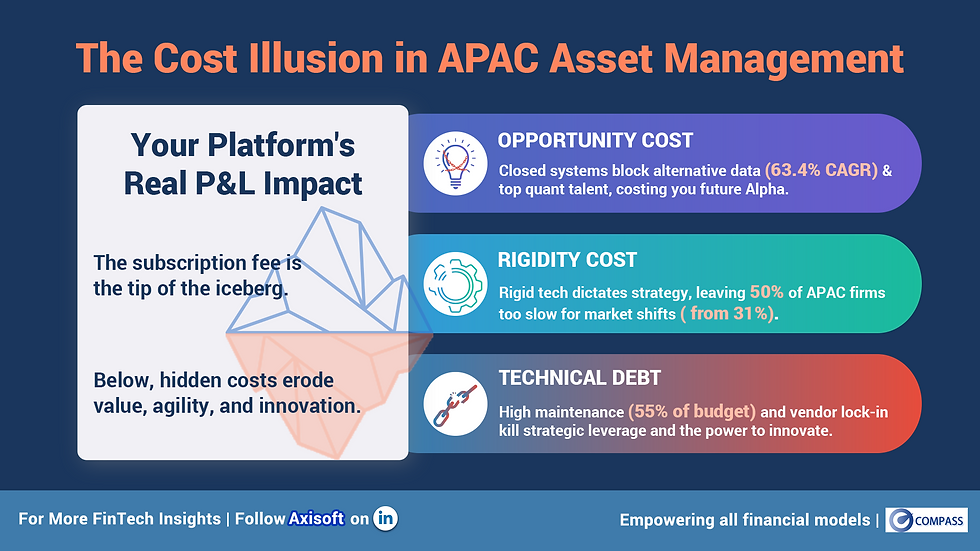

True Total Cost = Explicit Procurement Costs + Hidden Opportunity Costs + Hidden Rigidity Costs + Hidden Technical Debt

These three neglected hidden costs are the very source of the "cost illusion."

Opportunity Costs: How Closed Platforms Lock Away Innovation and Talent

Is your analytics platform causing you to miss out on future Alpha?

Opportunity cost is the price paid for choosing a closed, traditional platform, thereby forgoing the innovative potential of the entire open-source world.

The Opportunity Cost of Strategic Innovation: Today, Alpha is increasingly derived from alternative data. The global alternative data market is projected to explode at a CAGR of up to 63.4% (Grand View Research, 2024). Behind this data lie new investment opportunities. However, the "proprietary data formats" of traditional platforms block you from integrating this valuable data. When your platform cannot digest the data that will define the future, you are missing a market edge.

The Opportunity Cost of Top Talent: Today's top quantitative analysts and data scientists are fluent in Python and R. Over 70% of quant professionals use these open-source languages (MoldStud, 2025). The best minds use the most efficient tools. When your core platform forces this talent into a closed, outdated stack, you not only stifle creativity but also push them towards your competitors.

Rigidity Costs: When Your Business Adapts to Your Technology

Are your business processes being slowed down by your technology platform's fixed rhythm?

Rigidity cost is the price your organization pays in sacrificed agility.

Rigidity in Business Responsiveness: The APAC market is in constant flux. When a market opportunity appears, but your platform needs six months for a new analysis module, the opportunity is gone.

A "One-Size-Fits-All" Misfit in APAC: The rigidity cost of a global platform is amplified in the diverse APAC region. A Deloitte survey highlights this, with 50% of companies in 2024 stating their tech infrastructure can't meet new business needs, up from 31% in 2023 (IT Brew, 2024). This signals a critical disconnect between technology and business.

Technical Debt: The Interest Paid to Maintain the Status Quo

Are you aware that for short-term convenience, you may be taking on a long-term, compounding technical debt?

This debt manifests as functional rigidity, integration struggles, and the most dangerous of all: "vendor lock-in." This imprisons your data and core analytics within a single vendor, stripping you of bargaining power. The same Deloitte survey revealed that CIOs spend, on average, a staggering 55% of their budgets merely on maintaining current operations (IT Brew, 2024). This is the non-value-adding "interest" you pay on legacy systems.

Financial Performance vs. Long-Term Health: The Pursuit of Dynamic Resilience

Is your platform's "stability" true security, or a strategic anesthetic?

These hidden costs systematically erode your firm's long-term competitiveness. Today, "stability" means "Dynamic Resilience"—the ability to adapt and find opportunity in uncertainty. A Harvard Business Review analysis states that the right digital transformation actions can boost market cap by 5%, while the wrong ones can cause a 9% value erosion risk (Harvard Business Review, 2023). This 14-point gap reveals the direct impact of technology strategy on value.

When your core platform weakens your firm's dynamic resilience, its "stability" becomes a strategic liability.

Conclusion: A Moment of Decision for APAC Asset Management

Your core analytics platform: is it an asset propelling your firm forward, or a liability holding it back?

In the fast-paced APAC asset management market, your answer to this question will define your future.

It is time to make a choice.

Follow us on LinkedIn or subscribe to “FinTech Insights” for more information about FinTech.

References

BCG. (2025). BCG Global Wealth Report 2025.

Grand View Research. (2024). Alternative Data Market Size & Share, Industry Report, 2030.

Harvard Business Review. (2023). Do You Really Know The Financial Impacts of Your Digital Transformation?.

IT Brew. (2024). Legacy technology is still costing businesses big time, Deloitte survey finds.

MoldStud. (2025). From Data Analyst to Quantitative Analyst - Essential Steps for a Successful Career Transition.

Disclaimer: This article is for informational purposes only and is not investment or professional advice. Information and views are from public sources we believe to be reliable, but we do not guarantee their accuracy or completeness. Content is subject to change. Readers should exercise their own judgment and consult a professional advisor. Any action taken is at your own risk.

Copyright © 2025 Axisoft. All Rights Reserved